The Inheritance Hypothesis

This hypothetical is a well disguised composite of several actual cases. A couple had three sons in their mid-40s when we met them. The couple had achieved very significant wealth from a successful business and other investments, and they were staring at a 7-figure estate tax at death. They had been advised to make annual gifts not exceeding the annual exclusion (which is now $15,000 but was a little less at the time). They were giving each son $24,000 per year (half from each spouse). The kicker was they were making the gifts in monthly installments of $2,000 that felt like a paycheck.

Compared to a paycheck, each gift of $2,000 was deceptive: no income tax withheld, no Social Security or similar payroll tax paid. Based on this plus other trust income from a grandparent, one of the sons had already “retired.” The other two had jobs to some extent, but it felt like neither of them was employed full time, full throttle, the way one would be if he were supporting a family and had no other source of income.

As we were planning for after the couple died, I came to realize it is possible to receive too much of a good thing. Have you ever heard the phrase, Trust Fund Baby?

- With the annual gift program, while the parents were probably having an adverse effect on their children’s incentive, they at least had the power to turn it off or throttle it back.

- As we were planning for after the couple had both died, the clients were in danger of creating trusts that might have an irrevocably adverse impact on the sons and their children.

Conventional estate planning focuses primarily on maximizing the wealth that passes to the next generation (or other beneficiaries) with the lowest estate taxes (Tax Planning). A further emphasis of conventional estate planning is protecting assets from attack in the event a beneficiary has financial problems or suffers a catastrophic lawsuit (Asset Protection Planning).

Conventional estate planning often stops here.

All of us want what is best for those we love. It makes us happy to think that what our children or designated beneficiaries receive from us will make their lives better. An inheritance can create many opportunities such as:

- Money for a grandchild’s college education.

- Resources to acquire a cottage where the family can build shared experiences, a family retreat.

- Opportunity for more extensive travel.

- A more secure retirement some day.

You can make your own list.

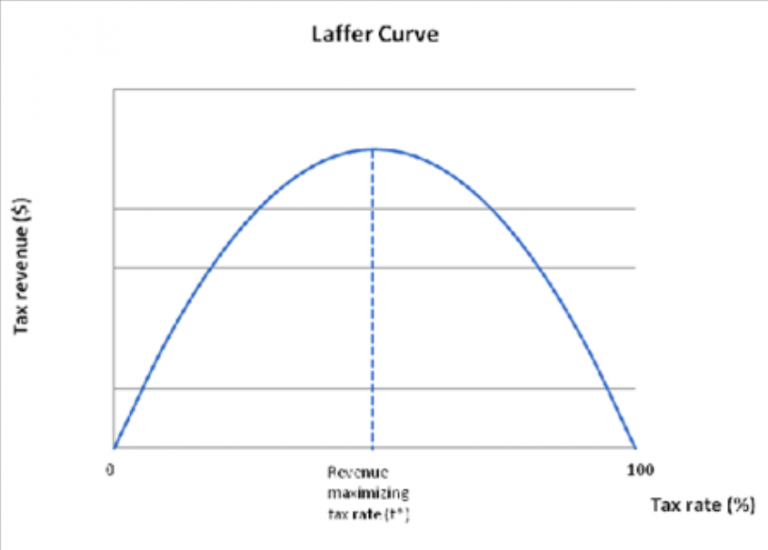

The Inheritance Hypothesis acknowledges that circumstances vary from family to family and person to person, yet it recognizes that, sometimes, there is some amount of inheritance, beyond which more harm than good may result.

Many clients will never be in danger of reaching the point of leaving “too much” money to a child, but for those who are, the danger is that as the size of the inheritance continues to increase, the results may turn negative.

We have created a tool, inspired by the Laffer Curve, to illustrate the dilemma with a diagram to help clients clarify their goals.

The analysis will vary, depending on your values and the particular facts. This analysis may evolve.

- The danger is that if you have significant wealth and fail to consider the potentially negative impacts of wealth on your beneficiaries, you risk doing more harm than good. If you are creating multiple-generation trusts with significant amounts to benefit generations not yet come of age, you could be playing with fire.

- The opportunity is to use our process to help you optimize an inheritance plan, typically with multiple layers or approaches, which gives you peace of mind in knowing you have done the best you can by the one you intend to benefit, and perhaps mix in philanthropic goals, once you have first provided generously for your family and other beneficiaries.